Member-only story

How To Read Candlesticks For Stocks & Crypto

Understanding the story the markets are telling you

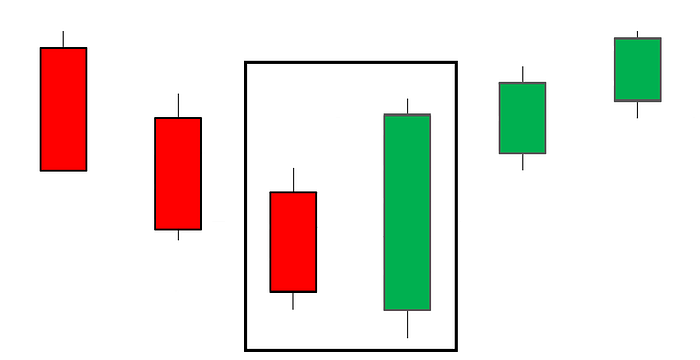

If you’ve been operating in the crypto or stock investing space for at least a short while, I’m sure you are at least vaguely familiar with candlesticks. These often misunderstood green and red bars can be extremely powerful sources of information when used correctly.

There are countless strategies and patterns which you can find online which are derived from candlesticks and their formation. I will write other posts in regards to which strategies I think are effective and which are not at a later date. This particular article is to very simply explain the basics of candlesticks and what they are telling you about the current price action in the markets.

A Brief History

Although the true origin of candlesticks is not confirmed, folklore states that candlestick charts are thought to have been developed in the 18th century by Munehisa Homma, a Japanese rice trader. it is then thought, Steve Nison popularized candlesticks in the western world with the release of his 1991 book, Japanese Candlestick Charting Techniques: A Contemporary Guide to the Ancient Investment Techniques.

The true origin is less important than the value that candlesticks can provide in telling us what the market is doing and how we can respond to it. Let’s take a deeper dive.

Bodies & Wicks

The candlesticks tell you what has happened in a user-defined period of time. You can have 1-second candles all the way to yearly candles and any denomination in between. If it is a 1-second chart, the bars will be in 1-second intervals, and so on.

Once you have defined your time period, it’s time to analyze what each bar and its features are telling you. Let’s start with the color. For the sake of this article, let’s assume all candles are on a daily time frame. If the bar is green (bullish), it means it is up from the previous day’s closing position. If the bar is red (bearish), it is down from the previous day’s closing position. Simple enough.